???? Kate Fitzgerald from Payment Systems Regulators in the UK shared invaluable insights on reshaping the future of payments, ensuring protection, fostering effective competition, and delivering inclusive services to meet everyone's needs.

???? We then explored how ATM outsourcing, led by Brinks in the Netherlands, accelerates customers' digital banking experiences. With a global presence and a focus on economics, compliance, and security, Brinks leverages AI for enhanced security, fraud detection, customer services, and predictive analytics.

☀️ Joseph Mucheru from Jumo in Kenya brought warmth and energy, showcasing Jumo's AI-driven solutions offering savings, credit products, and core banking infrastructure to empower entrepreneurs in emerging markets, addressing the challenge of financial inclusion.

???? Estrella Mota Perez from BBVA highlighted the evolving digital channel strategies for SMEs, emphasizing the importance of user experience, accessibility, cybersecurity, and integration of AI and chatbots.

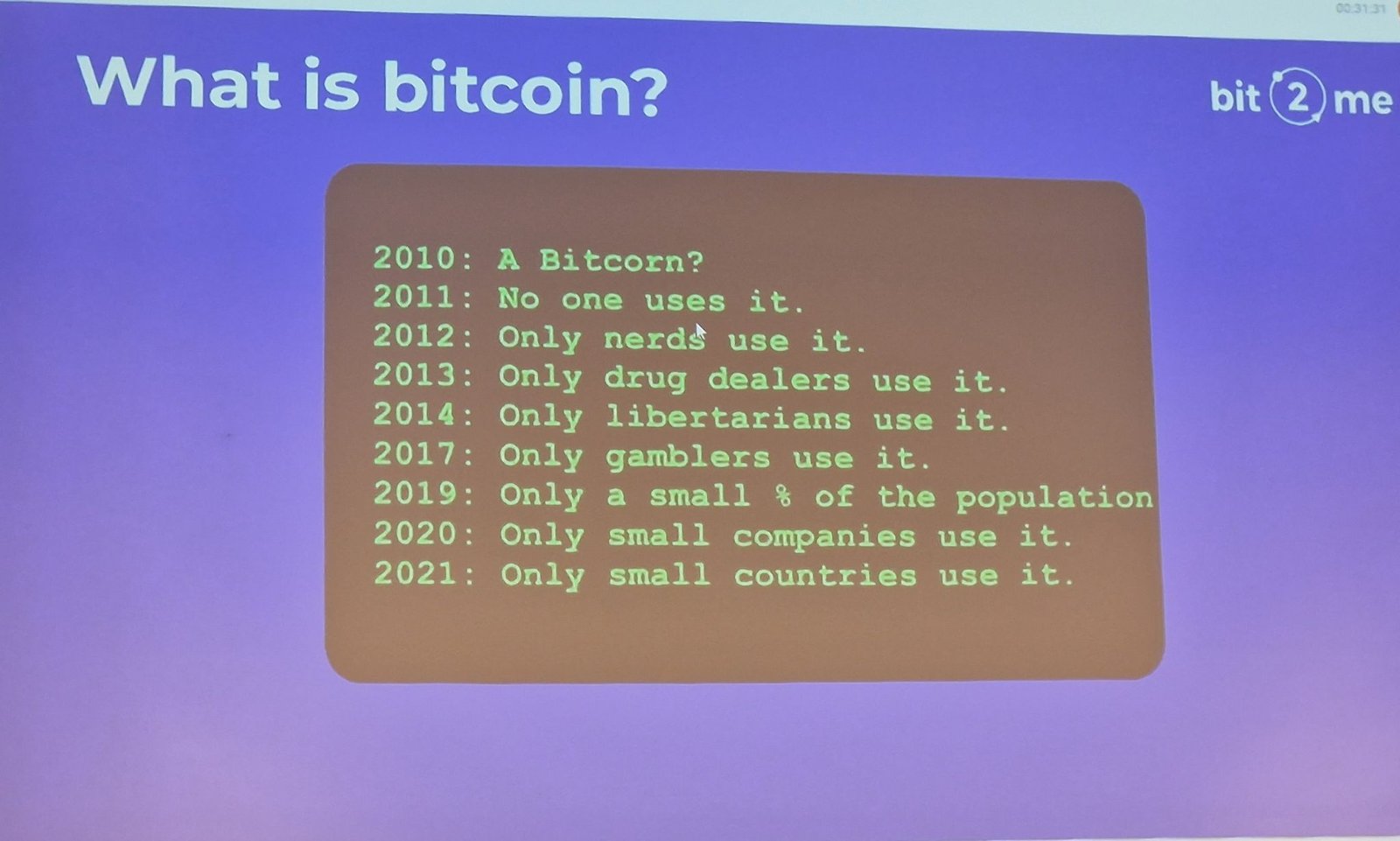

???? Lastly, David Porter from the Bank of England shared thought-provoking insights on AI's current state and future potentials. As AI evolves, maintaining pragmatism, transparency, and security becomes paramount to ensure ethical and effective deployment. NB: image from his presentation noting it represents his opinions only and not the ones from Bank of England.

???? A huge bravo to the PulseCore Events, moderators, and 350 participants!

A remarkable journey filled with learning and collaboration! Looking forward to applying these insights to drive positive change in the financial landscape. ???????? hashtagDigitalBanking hashtagArtificialIntelligence hashtagFinancialInclusion hashtagCollaboration hashtagLeadership